Resident companies are taxed at the rate of 24. TARIKH KEMASKINI 06062021 03-8911 1000 Hasil Care Line 03-8751 1000 Hasil Recovery Call Centre LhdnTube LHDNMofficial LHDNM LHDNM wwwhasilgovmy.

How To Claim Income Tax Reliefs For Your Insurance Premiums

For small and medium enterprise SME the first RM600000 Chargeable Income will be tax at 17 and the Chargeable Income above RM600000 will be tax at 24.

. What you can read next. - Feb 19 2021 Johor Bahru JB Malaysia Taman Molek Service THK Management Advisory - Our accounting firm specializes in company secretarial practice HR payroll services outsourced bookkeeping and accounting services. THK Management Advisory Sdn Bhd - Medical Fee on director is a tax exempted BIK.

19 NOVEMBER 2019. A tax relief of rm 3500 also exists for those supporting a disabled spouse. TAX TREATMENT OF LEGAL AND.

We have steady monthly 5 figure business profit. - Feb 19 2021 Johor Bahru JB Malaysia Taman Molek Service THK Management Advisory - Our accounting firm specializes in company secretarial practice HR payroll services outsourced bookkeeping and accounting services. Director General of Inland Revenue Malaysia.

Income tax Malaysia starting from Year of Assessment 2004 tax filed in 2005 income derived from outside Malaysia and received in Malaysia by a resident individual is exempted from tax. Under section 131 b Income Tax 1967 medical and dental benefits are exempted from income tax for employees. And deduct and remit the Monthly Tax Deduction PCB to the IRBM by 15 Jan 2020.

Is directors medical expense tax-deductible in Malaysia. Special relief for domestic travelling expenses until YA 2021. Updates and Amendments 32.

Statutory audit fees expenditure PUA 129 - Income Tax Deduction For Audit Expenditure Rules 2006 54 Defending title to property. In general medical fee for the employee is tax-deductible under S 33 of the Income Tax Act 1967. Monthly Tax Deduction MTD 31 11.

Why is Tax Planning so Important. Directors Remuneration and Tax Planning- Evidence from Malaysia. The membership subscription paid to professional bodies for ones profession like medical or legal professional fees can be claimed as a deduction.

Medical benefit child care benefit transportation fee for interstate travel. By Thursday 12 January 2017 Published in Tax Planning. VICTOR CHOONG must report this director fee income in respect of year 2019 in his Form BE 2019 or Form B 2019 even though he has only received the fee on 10 Jan 2020.

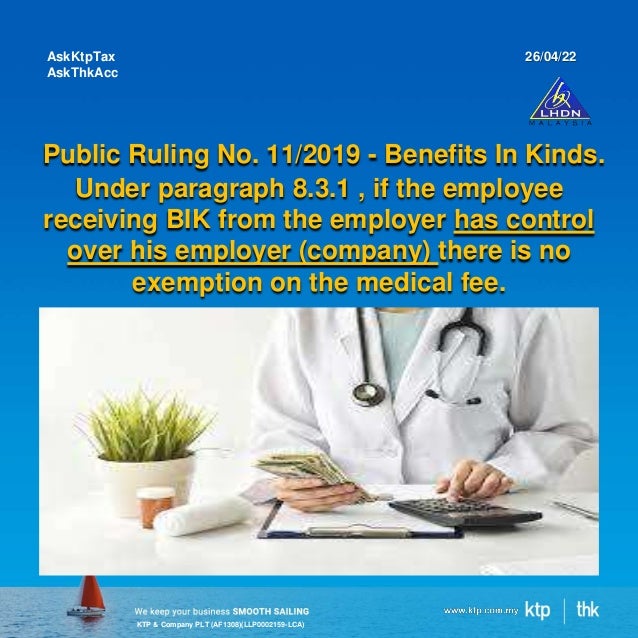

Medical bills rent and shares. Government of Malaysia v Mahawira Sdn Bhd Anor CA On 14 March 2019 the Inland Revenue Board IRB issued its Public Ruling. KTP Company PLT AF1308LLP0002159-LCA In general medical fee on employee is tax deductible under S 33 of the Income Tax Act 1967 AskKtpTax AskThkAcc.

Directors Remuneration and Tax Planning- Evidence from Malaysia. KTP Company PLT AF1308LLP0002159-LCA Can directors medical fee tax deductible in Sdn Bhd. Here is the list of Company Tax Deduction in year 2021.

3423 total views 6 views today. 14 Income remitted from outside Malaysia. Non-deductible legal and professional expenses 3 6.

Is directors medical expense tax-deductible in Malaysia. Secretarial fee tax deduction malaysia 2019. In general medical fee for the employee is tax-deductible under S 33 of the Income Tax Act 1967.

Were thinking of payout director fees. Effective date 5. Ive run a Sdn Bhd company since last year.

INLAND REVENUE BOARD OF MALAYSIA Translation from the original Bahasa Malaysia text DATE OF PUBLICATION. From Year of assessment 2020 not applicable for 201920182017 couples seeking fertility treatment such as in-vitro fertilisation. Updated guidance addresses the taxation of professional services and specifically amounts paid to directors and office holders.

112019 - Benefits In Kinds. Expenses incurred on secretarial and tax filing fees give a tax deduction of up to RM5000 and RM10000 respectively for each year of assessment YA. Section 138A of the Income Tax Act 1967 provides that the Director General is empowered.

For example if you take up a job while overseas and you only receive the payment for the job when you are back in. More on what qualifies for tax deductions. If you are an employee they are not deductible.

AskKtpTax AskThkAcc 260422 2. Payments to foreign affiliates. Sunday 29 Apr 2012.

A Malaysian company can claim a deduction for royalties management service fees and interest charges paid to foreign affiliates provided that these are made at arms length and the relevant WHTs where applicable have been deducted and remitted to the Malaysian tax authorities. The Royal Malaysian Customs Department RMCD released an updated service tax guide on professional services professional services guide dated 21 September 2021 which includes a significant update to the RMCDs views on the service tax treatment of payments received by a companys non-executive directors NEDs appointed under a. Total tax payable will be s7350.

Now we are planning to have payout from company as we didnt draw a single cent since beginning. Additional deduction of MYR 1000 for YA 2021 increased maximum to MYR 3000. Deduction Claim By Employers 31 12.

WITH the income tax deadline a. Read a September 2021 report prepared by the. Quickly jot down and share to your friends.

112019 - Benefits In Kinds. By Compiled LISA GOH. We are in equal share stake 50 - 50.

The SME company means company incorporated in Malaysia with a paid up capital of ordinary share of not more than RM25 million. Does the mention of Taxation Stress You. Declare Bonus or Director Fee in Accrual Basis.

Director medical fees tax deductible malaysia 1. Declaration of bonus or director fee 2021 although payment made in 2022 are eligible for tax deduction. THK Management Advisory Sdn Bhd - Medical Fee on director is a tax exempted BIK.

The tax treatment of medical. Under section 131 b Income Tax 1967 medical and dental benefits are exempt. Weve 0 employee as me and partner running the business by own.

Changes in year 2020 onwards. Accommodation fees on a tourist accommodation premises registered with the Ministry of Tourism Arts and Culture Malaysia. Entrance fees to tourist attractions.

A notable update addresses the service tax treatment of directors fees or fees paid to office holdersincluding allowances and benefits-in-kind provided to directors. Secretarial and tax filing fees being combined such that a total deduction of up to RM15000 per YA be allowed for both expenses from YA 2020 onwards.

Malaysia Income Tax 2022 A Guide To The Tax Reliefs You Can Claim For Ya 2021 Buro 24 7 Malaysia

We Are Hiring Operations Management Recruitment Agencies Job Hunting

Making Machine 30000pcs In Stock Medical Gown Protective Uniforms Making Machine Making Glass Enigma Machine

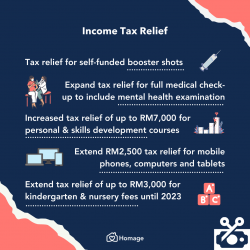

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

Everything You Should Claim For Income Tax Relief Malaysia 2021 Ya 2020

Updated Guide On Donations And Gifts Tax Deductions

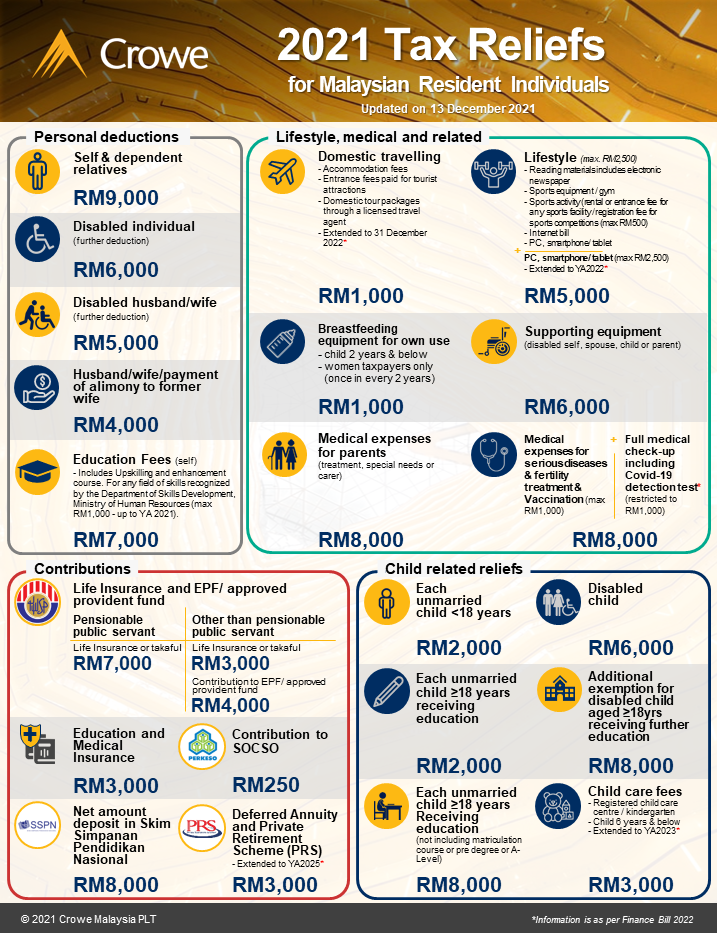

Infographic Of 2021 Tax Reliefs For Malaysian Resident Individuals Crowe Malaysia Plt

Comparison Of Standalone Medical Card Plans In Malaysia

Claims For Income Tax Relief Malaysia 2022 Ya 2021 Funding Societies My

Director Medical Fees Tax Deductible Malaysia

Malaysia S Budget 2022 Key Takeaways For Employers And Hr To Note

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

Medical Fee On Director Is A Tax Exempted Bik Feb 19 2021 Johor Bahru Jb Malaysia Taman Molek Service Thk Management Advisory Sdn Bhd

Malaysia Income Tax 2022 A Guide To The Tax Reliefs You Can Claim For Ya 2021 Buro 24 7 Malaysia

What You Need To Know About Income Tax Calculation In Malaysia Career Resources

Everything You Should Claim As Income Tax Relief Malaysia 2022 Ya 2021

Personal Tax Relief 2021 L Co Accountants

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

Everything You Should Claim For Income Tax Relief Malaysia 2021 Ya 2020